Selling price formula with profit percentage

Markup Percentage Selling Price Per Unit Cost Price Per Unit Cost Price Per Unit 100. If the CP of a commodity 800 and SP 900 then lets find the profit.

Profit And Loss Important Formulas Profit And Loss Statement Aptitude Loss

B Profit margin which is the percentage calculated using the selling.

. Shrimp - Cost 1500 - Selling Price 3000 - Food. In its simplest form percent means per hundred. Cost price formula when loss percentage and selling price are given is as follows.

Based on the formula Hot Pies Bakery Supply has a selling. Selling Price Rs. Now selling price is the cost at which a commodity is sold and cost price is the cost at which the commodity was bought originally.

Profits and losses are usually depicted as profit per cent to know how much profit or loss a businessindividual gets. It is denoted by the symbol and is majorly used to compare and find out ratios. Selling Price 210.

Simply enter your gross cost for each item and what percentage in profit youd like to make on each sale. Formula examples for calculating percentage change percent of total increase decrease a number by per cent and more. But when the product is sold at selling price lesser than the cost price it is termed as loss.

Profit SP - CP 900 800 100. Profit margin is calculated with selling price or revenue taken as base times 100. In other words we can say that 1500 1350 Rs 150.

Sales Formula Example 1. 1500 Rs 150 Therefore the Discount for Rs 100 1501500 100 10 Thus the Percentage of discount 10 and the correct option is B 10. When cost price is given and a certain percentage of profit on selling price has to be calculated then following formula will be adopted On the basis of above information profit will be calculated as follows.

Profit Selling Price SP Cost. The selling price formula when loss percentage and cost price are given is as follows. Where P is the profit and CP is.

It is the percentage of selling price that is turned into profit whereas profit percentage or markup is the percentage of cost price that one gets as profit on top of cost priceWhile selling something one should know what percentage of profit one will get on a particular investment. With a markup percentage of 50 you should sell your socks at a 250 markup or a total price of 725. Using the Profit Formula Profit Selling Price - Cost Price.

Markup Percentage 300 180 180 100. GDP Per Capita Formula. Let us take the example of a toy-making company that sold 10 million toys during the year.

Cost price of the pack of pencils 25. Profit percentage is of two types. 5 x 50 250 5 725 New Selling Price.

Return on Capital Employed Formula. Therefore the profit earned in the deal is of 5 and the profit. Profit Percentage 525 100 20.

Here is what the selling price formula would look like in action. P PCP 100. After covering the cost of goods sold the remaining money is used to service other operating expenses like sellingcommission expenses general and administrative expenses Administrative Expenses Administrative expenses are indirect costs incurred by a business that are not directly related.

The profit percentage formula calculates the financial benefits left with the entity after it has paid all the expenses and is expressed as a percentage of cost price or selling price. Lets understand the application of these formulae with the following simple example. The basic components of the formula of gross profit ratio GP ratio are gross profit and net sales.

It is defined as a number represented as a fraction of 100. Once the profit is calculated we can also derive the percentage profit e have gained in any business by the formula given here. Amount of discount is Marked Price Selling Price.

CP SP x 100100 - loss The selling price formula when profit percentage and cost price are given is as follows. A vendor purchased a book. Selling price 30.

To express a number between zero and one percentage formula is used. To calculate the profit percentage you will need the below-mentioned formula. The formula of gross profit margin or percentage is given below.

A Markup expressed as a percentage of cost price. Determine the right selling price for your products and increase your profits. Net Operating Income Formula.

Profit 30 - 25 5. Gross profit is equal to net sales minus cost of goods sold. Therefore Loss Cost Price Selling Price.

Given below are the formulas to calculate profit. Selling Price 150 40 x 150 Selling Price 150 04 x 150 Selling Price 150 60. The cost price for each bread machine is 150 and the business hopes to earn a 40 profit margin.

Profit Percentage Margin Net Profit SP CPSelling Price SP X 100. Gross profit percentage formula Total sales Cost of goods sold Total sales 100. Percentage formula is used to find the amount or share of something in terms of 100.

Out of the total 3 million toys were sold at an average selling price of 30 per unit another 4 million toys were sold at an average selling price of 50 per unit and the remaining 3 million toys were sold at an average selling price of 80 per unit. Profit Percentage Markup Net Profit SP CPCost Price CP X 100. Cost x 50 Margin Cost Selling Price Result.

Using the Profit Percentage Formula Profit Percentage ProfitCost Price 100. Calculate Gross Profit Margin on Services. The profit percentage or loss percentage is calculated with the help of the following formulas which show that the profit or loss in a transaction is always calculated on its Cost Price.

Im working on a spreadsheet in excel of food items and would like to see three different for the Selling Price. Marked Price Rs 1500 and Selling Price Rs 1350. Learn a quick way to calculate percentage in Excel.

The above formula can also be explained alternatively. After clicking calculate the tool will run those numbers through its profit margin formula to find the. Profit ProfitCP 100.

That means you will earn a profit of 250 on every pair of socks sold. It means the company may reduce the selling price of its products by 2582 without incurring any loss. SP 100 Profit 100 x CP.

Calculate Discount In Excel In 2022

Genevieve Wood I Picked This Diagram Because Of The Side By Side View Of The Contribution Margin And Traditional Income Statement I Felt Like You Can Easily S

Gross Profit Percentage Meaning Example Advantages And More Accounting Education Economics Lessons Learn Accounting

What Is A Florist S Markup How Much Do You Charge For Wedding Flowers Florist Pricing Guide Flower Math Flower Business Flower Shop Design

How Do You Find Percentage Profit Or Loss Maths Formula Book Math Formulas Find Percentage

Profit And Loss Rs Aggarwal Class 7 Maths Solutions Exercise 11a Maths Solutions Math Formula Chart Math Problem Solving Strategies

Profit And Loss Important Formulas Profit And Loss Statement Aptitude Loss

Techwalla Com How To Calculate Gross Profit Margin Using Excel Techwallacom B07bd92b Resumesample Resumefor Excel Gross Margin Calculator

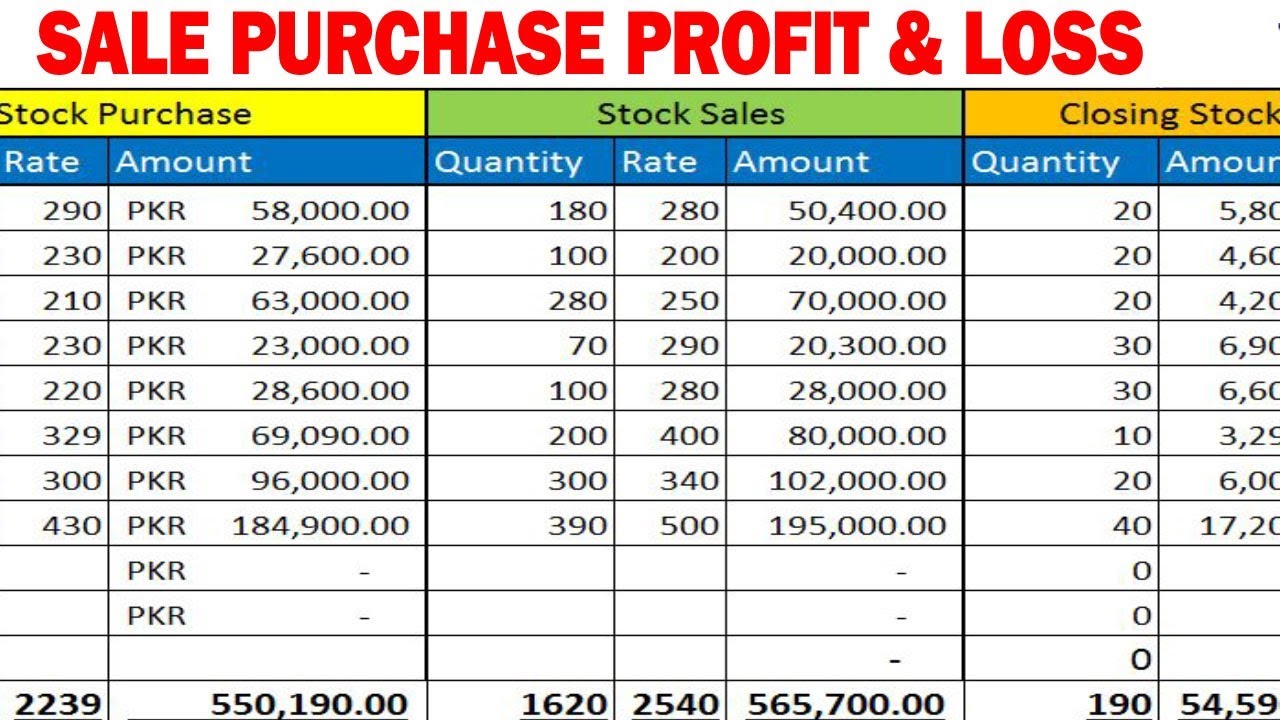

How To Make Stock Purchase Sales And Profit Loss Sheet In Excel By Lear How To Make Stock Learning Centers Excel Tutorials

Excel Formula To Add Percentage Markup Excel Formula Excel Microsoft Excel

Retail Markup Calculator Markup Pricing Formula Excel Margin Formula Pricing Templates Excel Spreadsheets Excel Templates

Excel Formula Get Profit Margin Percentage Excel Formula Excel Tutorials Start Up Business

How To Calculate Net Profit Margin In Excel Net Profit Profit Excel

Return On Assets Managed Roam Return On Assets Asset Financial Management

Product Pricing Calculator Template For Etsy And Paypal Seller Pricing Templates Excel Spreadsheets Excel Templates

How To Calculate Selling Price From Cost And Margin Calculator Excel Development

Pricing Formula Startup Business Plan Small Business Plan Bookkeeping Business